5 Simple Personal Finance Organization Tips to Stay on Track

Are you in need of simple and effective personal finance organization tips? Here are five of the best methods for organizing your personal finances so you can stay on track this year and achieve financial success.

This site contains affiliate links, view the disclaimer for more information.

Whether you’re a parent managing household expenses or a college student in your new apartment, organizing your personal finances is one of the most crucial steps you can take toward simplifying your finances.

When you’re trying to balance work and home life, the added task of managing your personal finances can feel daunting. But it doesn’t have to be. With just a few smart strategies and commitment to getting your finances back on track, you can confidently manage them right away—no matter how busy your life may be.

Maybe you’re thinking to yourself—“Yes I know, but half of the battle is figuring out how to keep organized to begin with.” Don’t worry. That’s why I’m making it easy and giving you these 5 simple tips. Let’s dive in!

5 Simple Personal Finance Organization Tips to Stay on Track

1. Set Clear Financial Goals

First and foremost, it’s important to ask yourself what your financial goals are. Without clear goals, it’s easy to lose track of your financial progress and ultimately be left in the same position you were in last year. To organize your personal finances and get one step closer to financial freedom, start by jotting down what your goals are. When doing so, break them down into 2 categories: short-term and long-term.

Short-term goals

Short-term goals could include setting up a retirement savings account such as 401(k) or Roth IRA, paying off your credit card debt, saving for your next trip, or building an emergency fund (more to come on building an emergency fund in tip #4). Start by identifying 3-5 short-term goals.

Long-term goals

Long-term goals could include buying a car, paying off your home or school debt, saving for retirement, or funding your child’s education. Start by identifying 2-3 long-term goals.

S.M.A.R.T. goals strategy

When setting goals, leverage the S.M.A.R.T. goals strategy. Make your goals Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of saying “Save money for vacation,” you can say “Save $2,500 for family vacation within 6 months.”

Using the S.M.A.R.T. goals strategy will allow you to easily break down goals into smaller, more manageable steps. If we know we need to save $2,500 in the next 6 months for family vacation, then we can calculate a monthly savings of $416.67 to ensure we achieve this goal within our ideal time frame.

Leverage this personal finance organization tip to set clear financial goals for yourself that will keep you motivated and organized on your financial journey.

Don’t forget to pin this!

Make sure to pin this image here and save it to your Pinterest board. That way you can easily come back to this page and learn 5 simple tips to keep your personal finances organized and achieve financial success.

2. Create a Personalized Budget—and stick to it!

Now that you have established your financial goals, it’s time to create a comprehensive, personalized budget that works for you. Ask yourself where your money is going and if your spending habits align with your personal financial goals (as identified with tip #1).

The basics of budgeting are all about tracking your income against your expenses, no matter how small. Every single dollar that you make or spend needs to be accounted for. Yes. Every. Single. Dollar. Why is it so important?

Using this method of tracking every dollar allows you to more carefully see how every dollar is going in and out of your bank account. Discover my favorite tool for tracking this in tip #5: personal finance apps. The better understanding you have of where your money is going, the easier it will be to establish a realistic budget. This will also make it easier to identify both smart and poor spending habits when it comes time to reevaluate and optimize your budget (I recommend doing this regularly—whether every couple of months or twice a year).

The key is balance. You want to ensure you are not overspending but also allow room for you to enjoy life now while investing in your future self. Your budget doesn’t need to be so restrictive that you can’t afford that $5 beverage you know would have REALLY picked you up this week. However, you want to make sure you are not overspending on non-essentials that hinder you from truly investing in your long-term goals. It’s all about finding that sweet spot.

If it’s your first time creating a budget or you’re looking to optimize your current one, here are some budget categories to consider:

Budget Categories

| Income | Expenses |

| Paycheck 1 | Giving (donations) |

| Paycheck 2 | Savings (emergency fund, retirement) |

| Paycheck 3 | Housing (rent, storage, utilities) |

| Paycheck 4 | Transportation (gas, tolls, taxis, car payment) |

| Gift Money/Rewards/Cashback | Food (groceries, restaurants) |

| Interest/Dividends | Personal (misc. subscriptions) |

| Misc. | Lifestyle (pet care, hair appointment, clothes shopping) |

| Insurance (health, home, life, auto) | |

| Debt |

By creating a budget that is tailored to you, you’ll be able to better organize your personal finances and make conscious spending decisions that align with your financial goals. Learn more specifics on tracking your budget in tip #5.

3. Automate your Finances

One of the best methods for maintaining personal finance organization without all the stress and hassle is to automate your finances. Think about all those bills you’re paying month-to-month like rent, utilities, auto-insurance, subscriptions, credit card debt,… You’re probably spending at least 5-10 minutes each time you go in to make a payment—and that’s just per bill. Over time, those minutes add up.

Instead of spending that time on manual payments, set up automatic bill payments. This way, you can free up those minutes to do things you actually enjoy—like spending time with your family or finally starting that new Netflix series.

I especially love this method for savings accounts. Each month, you can have money automatically go into your 401(k) or retirement savings account before your paycheck gets deposited. The good news is, once the money is automatically transferred to your savings, you won’t even notice it’s gone—and you won’t be tempted to spend it. Financial savings goal? Check!

By taking advantage of financial automation, you can spend more time focusing on other aspects of life while still staying on track with your financial goals. No more wondering, “Wait! Did I remember to pay that bill?”

Find Smart Tools to Budget Better, Save More, and Work From Anywhere

Ready to make life (and money management) a little easier? Check out my favorite tools, books, and essentials for budgeting smarter, building real savings, organizing your home office, and thriving in remote work—so you can create the flexible lifestyle you’re working toward.

4. Build and Maintain an Emergency Fund

No matter how old you are, how much debt you have, or what your financial goals are—I cannot stress this enough. Build. An. Emergency. Fund.

“What is an emergency fund for?”

An emergency fund is like a financial safety net. Having an emergency fund not only keeps you prepared for the unexpected, but it gives you peace of mind, knowing that you have the right measures in place when things go downhill. We’re talking about when your car breaks down, you need to take medical leave, or your cat knocks over the TV (cat owners, you know what I’m talking about!). Your emergency fund is there to keep you at bay.

And here’s the thing: even if you’re working on paying off debt, it doesn’t mean you can’t save. As we covered in Tip #1, you can balance long-term goals (like retirement savings) with short-term goals (like debt repayment). Saving for emergencies and tackling debt doesn’t have to be mutually exclusive.

“How much do I need to save?”

A good rule of thumb for how much to save is 6 times your monthly (gross) income. Therefore, if you make $30,000/yr then you should aim to build an emergency fund of approx $15,000. Now, I know how intimidating this can sound. But even if you are only contributing $50 a month, something is better than nothing. What you invest now in your emergency fund, doesn’t have to set the tone for what you can invest in the next 3, 6, 9, or 12 months. Allow some flexibility here but give yourself a number to start with and try your hardest to stick to it.

Think about it this way: $50 a month times 12 months a year gets you $600 in savings. This could pay off that unexpected vet bill or new set of tires. Again, something is better than nothing. You just have to get started.

“But I already have an emergency fund. Now what?”

That’s fantastic—congratulations on reaching a very exciting milestone! If you’re comfortable with the size of your emergency fund and have other financial goals in mind, such as saving for a dream vacation or funding your child’s education, it might be time to reassess your priorities. Consider whether you want to reduce the amount you’re contributing to your emergency fund or redirect those funds toward one of your other goals.

That said, it’s essential to continue maintaining your emergency fund. If you end up having to fork out $600 from your emergency fund for a vet bill, be sure to contribute $600 back into your emergency fund as soon as you can so that you are maintaining your financial safety net.

5. Track your Finances

Last but not least, stay organized and on track of your personal finances by leveraging tools such as budget planners, file organizers and personal finance apps. Let’s dive into each one:

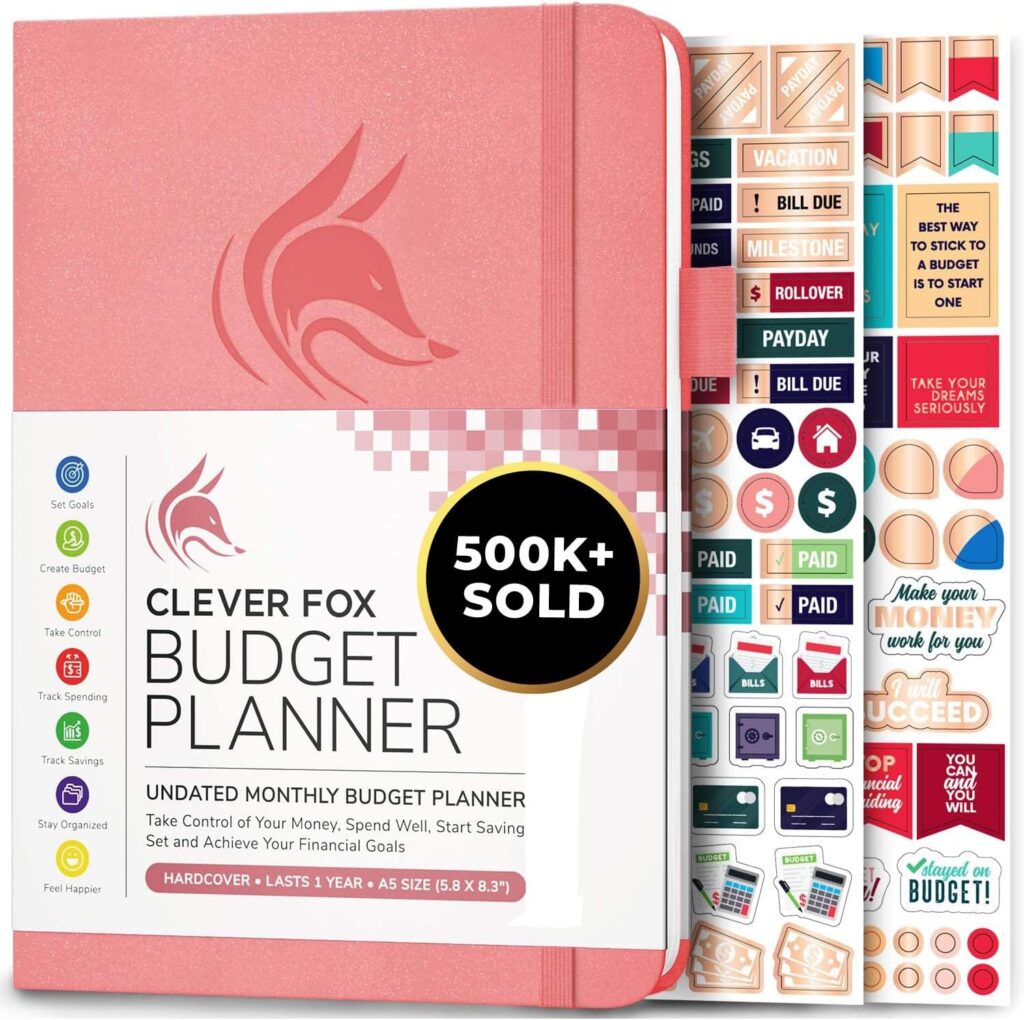

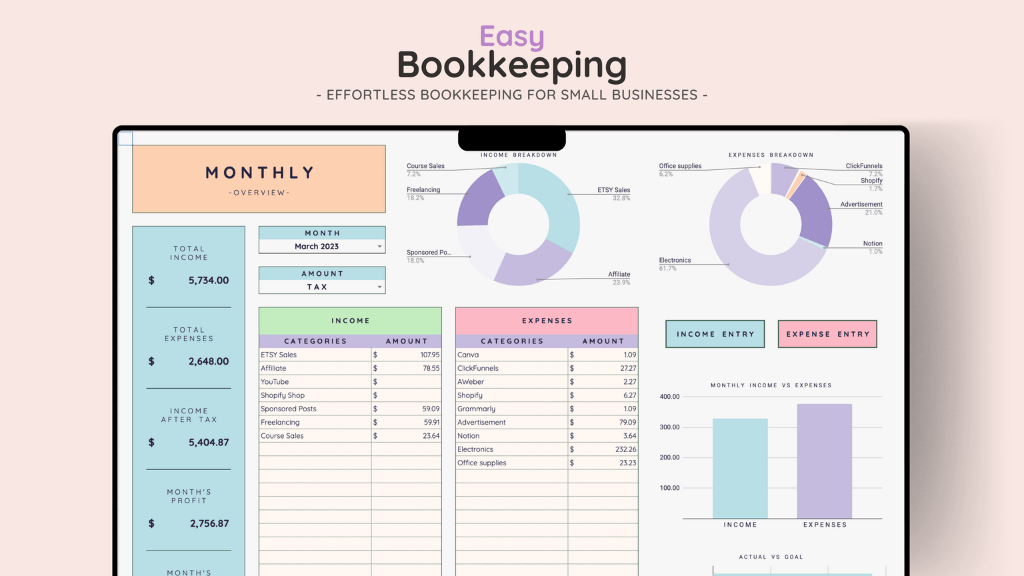

Budget Planners:

Budgeting planners make personal finance organization a breeze! They act as very simple yet effective ways to streamline your budgeting process. And the good news is—there’s an abundance of options for those who still prefer pen and paper as well as those who prefer digital tools. I’ve compiled some of my favorite options to help you find what works best for you.

cloud storage apps or file organizers

When tax season hits, it is SO important to have an organized system in place for storing financial documents. Take some time each month to make sure your financial documents are up to date and stored properly. You can use labeled folders or filing cabinets to categorize and store physical documents such as taxes, bank statements, bills, insurance information, and more. If digital is more your style, you can also use cloud storage apps like Google Drive or Dropbox to organize these same documents. This will not only enhance your personal finance organization but will help prevent any future financial headaches that may come along.

Personal Finance Apps:

There are plenty of personal finance apps to choose from, but my go-to for monthly spend tracking is Dave Ramsey’s EveryDollar app. I use the free version, which allows you to track income, expenses, and savings progress (like that emergency fund we talked about in tip #4). The app has three tabs: Planned Spend, Actual Spend, and Remaining Spend. These help you input your budget and monitor your spending in real time to make sure you stick to it.

The best part? Once you set up your budget and categories, you can easily copy and paste it from month to month. Each month, all you need to do is track your actual spending and adjust accordingly. If you want to make things even easier, you can opt for the paid version, which connects to your bank account for automatic tracking, but the free version is more than enough to get started.

Conclusion

Organizing your personal finances doesn’t have to be a complicated, overwhelming process. By following these five personal finance organization tips—setting clear financial goals, creating a personalized budget you can stick to, automating your finances, building an emergency fund, and strategically tracking your finances—you’ll be able to make confident financial decisions that you know align with your budgetary goals. Try out these tips now and watch how they transform your world of personal finances!

Weigh In!

I’d love to hear how you approach organizing personal finances or which tip helped you the most. Drop a comment below!

Wow! This was very informative! Budgeting can really be stressful and I’ve been working on my budget lately. Thank you for sharing this information. I really like the google doc budget tool.

Thanks, Dalton! I’m so glad you found this post helpful. Budgeting can definitely be stressful, but having a solid system in place makes a huge difference. Let me know if you have any questions as you’re working on your budget.