Are These 11 Unnecessary Expenses Secretly Sabotaging Your Budget?

Feeling like your budget is already stretched thin and you’re unsure what else you can feasibly do to cut back on unnecessary expenses? You’re not alone.

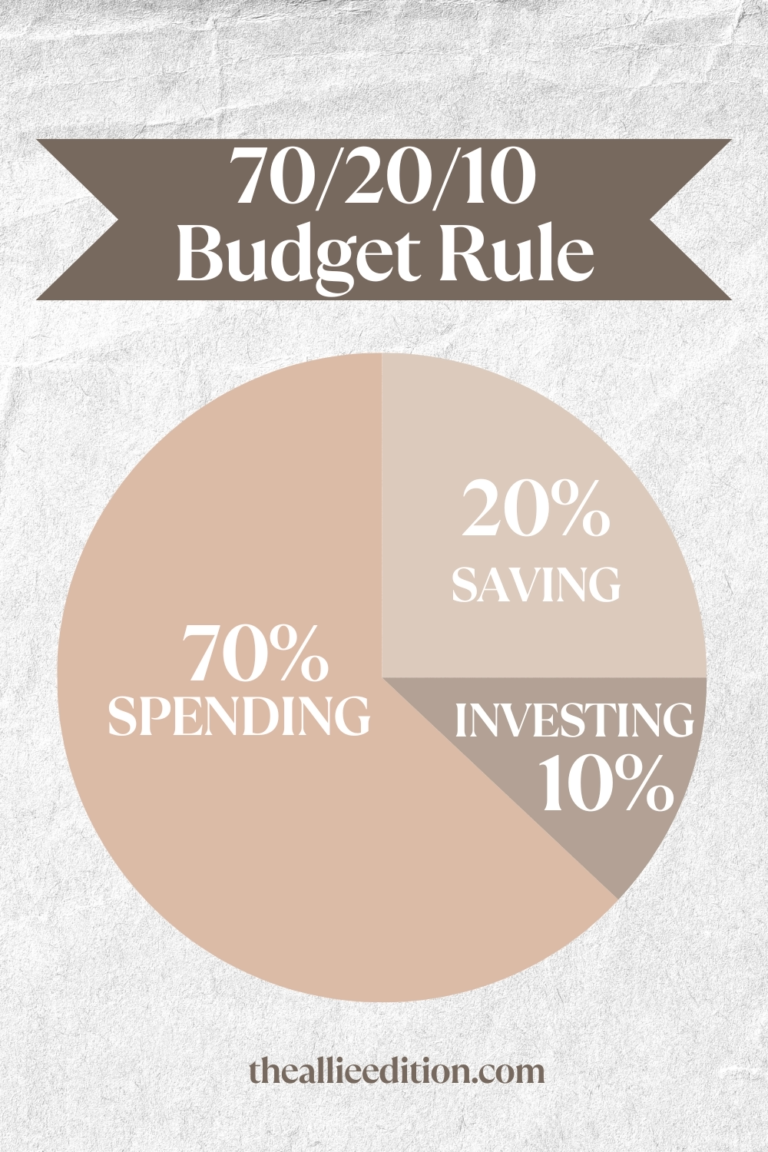

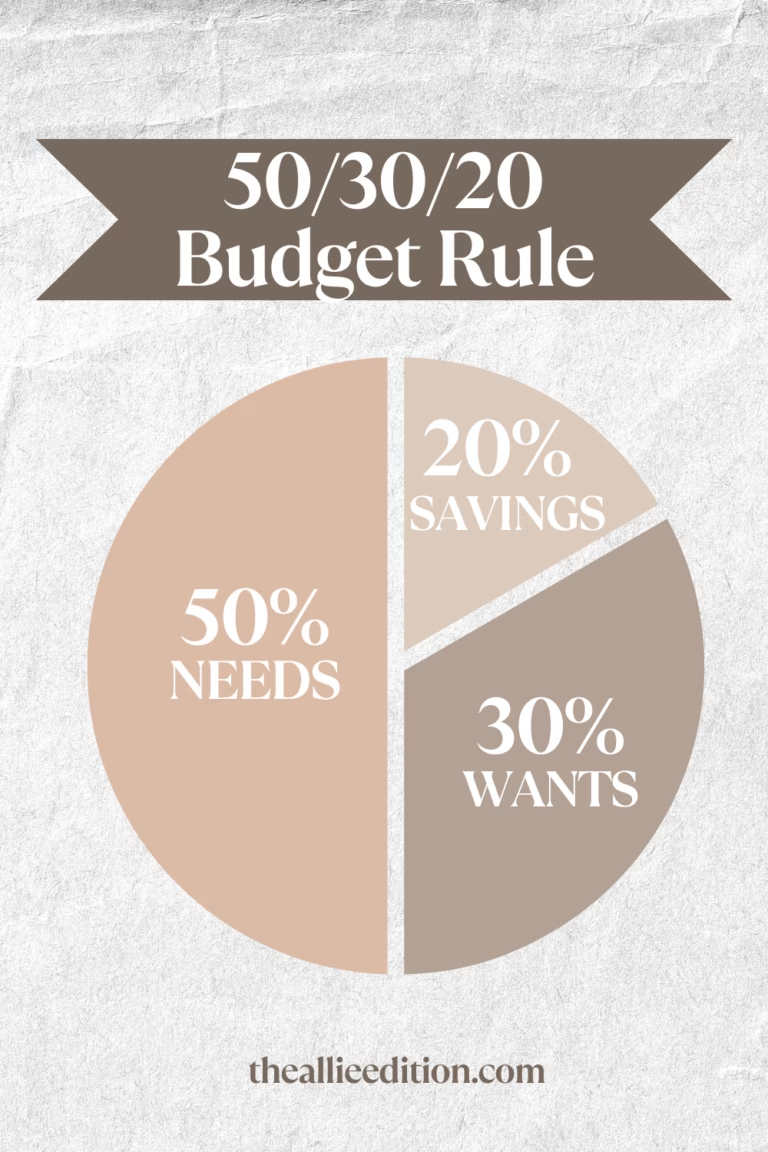

Cutting unnecessary expenses out might sound easy to do—just cut out the “wants” and focus on the “needs.” Right? Until you start looking at your expenses and realize that most of your spending feels like needs.

But here’s the truth. By making small changes in your financial routine, you can achieve big financial results that allow you to meet your savings goals, get closer to financial freedom, and make time for what matters most (like traveling or pursuing your dream remote job).

When you know which expenses to watch out for and how to start building smarter spending habits, budgeting becomes a whole lot easier. If you’re tired of unnecessary expenses throwing off your finance goals and causing you to feel guilty or stuck, this post is for you.

I’m sharing tips for cutting back on unnecessary expenses, how to identify expenses that may be draining your budget, and what you can do to stay on track without feeling burned out or deprived.

This site contains affiliate links, view the disclaimer for more information.

Welcome to part 9 of 10 in my personal finance blog series, where we dive into how a money saving plan can be your key to successfully transitioning from debt to savings. If you’re just joining us, be sure to check out the first post for a deeper dive into why a money saving plan is so crucial. It’ll lay the foundation for everything we’re discussing moving forward.

Part 1: Easy Wins to Cut Back on Unnecessary Expenses

Before we dive into 11 unnecessary expenses that could be sabotaging your budget, we’re going to start off with some easy wins you can start achieving today to help cut back and save money.

Pick a couple to start working into your spending routine and stack on more as you go. You’ll be surprised at how big of a difference it makes when you start implementing even the smallest of changes. Let’s get started!

Set Calendar Reminders Before Free Trials Expire

Mark your calendar 1-2 days before a free trial ends so you can cancel it before you get charged if you’re not satisfied (don’t you hate when that happens?!).

Buy in Bulk When It Saves You Long-Term

If it fits your budget, buying in bulk can be a great way to cut down on unnecessary expenses and save hundreds of dollars each month.

An easy place to start is with groceries—warehouse clubs like Sam’s Club, Costco, or BJ’s usually offer the best bang for your buck. Got a local butcher? See if they offer bulk deals on meat. If you don’t have these options nearby, you can check out these bulk pantry staples on Amazon.

Limit Trips & Plan Errands to Save Time and Gas

- Visiting the gas station? Fill your tank fully instead of partial fill-ups when on the go.

- Going to the grocery store? Try to limit your grocery shopping to once or twice a month instead of weekly visits.

- Running general errands? Batch your errands to avoid repeat trips and plan your route to be most efficient on gas mileage .

Don’t forget to pin this!

Make sure to pin this to your Pinterest board so you can easily revisit these smart tips on how to reduce unnecessary expenses.

Shop Big Sales and Off-Season Deals

Black Friday, Memorial Day, Spring Sales—waiting a little longer can save you a lot of money.

Feeling thrifty? Keep an eye out for nearby estate sales or store closures. I’ve been able to buy items in brand new (or near new) condition for a fraction of the price that major retailers charge.

Use Cash Instead of Card for Non-Essentials

I’m not a huge fan of carrying around a ton of cash—but when I was first learning to manage my money, it totally worked.

There’s just something about seeing your money physically leave your hands that makes each purchase feel more real. Give it a go for a few months and watch how it transforms your spending habits!

Cancel or Adjust Recurring Charges (Subscriptions, Insurance, etc.)

- Cancel anything you’re not using or that no longer fits your budget goals

- Be on the lookout for rate increases (unfortunately, this is super common and oftentimes you receive zero warning)

- Shop around at least once a year to look for better deals

Pick Up a Hobby or Side Hustle (Blogging Is My Go-To!)

Filling your time with creative projects or side hustles that earn you extra income doesn’t just help you avoid mindless spending or endless scrolling—it actually gives your day purpose.

For me, starting a blog was one of the smartest (and most rewarding) ways to spend my free time. It’s helped me earn extra income, tap into my creativity, and end each day feeling like I actually did something for me.

If you’ve been thinking about starting a blog—or turning your existing one into a money-making side hustle—I seriously recommend checking out Sophia Lee’s Beginner’s Blogging Bundle.

Try the 24–48 Hour Rule Before You Buy

Add to cart, walk away, and reassess after 24-48 hours. Most of the time, you’ll have found a better deal or won’t even want it anymore!

Use Free Loyalty and Rewards Programs

Have a local restaurant or shop you frequent? See if they have a free loyalty program you can sign up for (oftentimes with your phone number or email). Or, see if they have an app or punch card system.

This is an easy way to earn free products and save money from purchases you were already going to make.

I’ve gotten many free drinks, meals and $10 off coupons from doing this. And it only takes like 30 seconds!

Want to Start Earning from Blogging? Here’s How

For years, I dabbled in different side hustles, but nothing felt like the right fit—until I discovered blogging. I wanted something profitable, flexible, and enjoyable, but I had no clue where to start. After weeks of researching blogging courses, I finally found Sophia Lee’s Beginner’s Blogging Bundle, and it changed everything.

This bundle includes two courses: Perfecting Blogging and Perfecting Pinterest. Perfecting Blogging breaks down SEO strategies, Sophia’s step-by-step formula for creating high-quality blogs fast, and the exact strategies she used to grow her site into a six-figure business. Perfecting Pinterest reveals her traffic-driving secrets, time-saving content strategies, and how to maximize Pinterest for rapid blog growth.

If you’re just starting out or struggling to get traction, this bundle gives you a clear roadmap to success. I can confidently say it made my blogging journey 100x easier, and I know it can do the same for you!

Part 2: 11 Sneaky Unnecessary Expenses to Watch For

When you cut out the expenses that don’t serve you, you make more room for the things that do—like building an emergency fund, saving for a vacation, or even giving yourself a runway to switch careers or start that blog you’ve been dreaming about.

With that, let’s take a look at 11 of the most common unnecessary expenses that could be sabotaging your budget and smart tips you can implement to cut back.

1. Subscriptions You Forgot About

This one sneaks up on most of us. And it’s not necessarily the monthly subscriptions that get us. It’s those annual subscriptions that you pay for once a year.

You spend $99 for the first time, try it out, and halfway through the year you stop using it but completely forgot you ever paid for it. Next thing you know you get another $99 charge out of nowhere and—*face palm* oh yeah, THAT.

Pro Tip: Use a budget tracker to jot down all of your subscriptions and regularly audit your accounts. Cancel any subscriptions you’re not actively using, no longer satisfied with, or have had rate increases that no longer fit your budget goals.

2. Excessive Takeout and Hidden Delivery Fees

I’m not saying stop takeout and delivery altogether, but try to scale back or find ways to save money through what you’re already doing. This is where budgeting smart—not extreme—makes all the difference.

Pro Tip: Meal prep more, pick up instead of getting delivery, and limit takeout nights. When you do order, call the restaurant directly—apps like DoorDash, Toast, Seamless, and Grubhub often add fees and mark up menu prices. I’ve saved $15+ per order just by skipping these apps—that’s basically a whole meal’s worth of fees!

3. Late-Night Impulse Shopping

I’m guilty for this too, so I get it. But this can be easier to avoid than we think. Just takes a little discipline.

Pro Tip: Enforce a 24-48 hour rule where you wait this long before following through with the purchase. Further, try to reduce the number of days you allow yourself to shop online each month. Tend to shop online during weekends? Pick one day to commit to no spending.

Think of this as making space in your budget for what really lights you up (like that summer vacation!).

4. Being Loyal to Brand-Names Only

There are some things that I only get name brand because I’ve tried so many other products and nothing truly compares. But if you’re just going off of brand reputation and you haven’t really tried other products to compare for yourself, why not give it a go? You might just be surprised by how often the quality is just as good as the name brand option.

Pro Tip: Choose generic brands when possible. This includes food, drinks, medicine, clothes, accessories, tools & equipment, etc.

5. Paying for Warranties or Protection Plans You’ll Never Use

How many times have you purchased a warranty and actually used it? I’m talking about TVs, headphones, mattresses, rugs, bikes, concert tickets, excursions, clothing, shoes,…

Sure the extra protection can be nice (such as for a pricey airplane ticket), but sometimes we buy these to feel a sense of security when we know we won’t really need it or use it.

Pro Tip: Carefully assess if the extra coverage is actually worth it.

6. Random Bank Fees and ATM Charges

This is so minor but as with everything, money adds up! Anything you can do to avoid tacking on extra fees or charges is a financial win.

Pro Tip: Move to a no-fee or online bank to avoid additional charges. Make sure to pull cash when you’re near your bank or using an in-network ATM. Try to carry a little cash on you so whenever you’re in situations where cash is required, you’re prepared. No need to use their convenience ATM that charges an extra few dollars just to pull money from it.

7. Paying for Too Many Streaming Services

My family is huge on movies and when you’re being offered new movies regularly across multiple paid platforms like Hulu, Netflix, Disney+, and more, it’s tempting to pay for all of them so you can watch whatever you want, whenever you want.

But do you really need to? Are you realistically going to watch enough movies to make up for the amount you’re spending on streaming services? Unless you’re my friend who is a cinematic fiend, probably not.

Pro Tip: Limit to 1–2 services at a time and rotate as needed. For example, rotating between Hulu and Netflix depending on what you’re watching could save you $15-30 a month!

8. High Electric Bills From Easy-to-Fix Habits

If you’re using up all your outlets due to the number of electronics or household appliances you own, even when they aren’t in use, you could be unintentionally spiking your electric bill.

Pro Tip: Use smart power strips that require less energy when being used and unplug electronics when not in use.

9. Overpaying for Insurance

If you have any kind of insurance—car, home, health—then you know it’s not uncommon for rate increases to happen once or even twice a year.

I used to stay with the same car insurance company for 5+ years and then one day I realized, my insurance is up well over $150 from when I first enrolled. By making a few phone calls and getting a few more quotes, I was able to switch insurance and instantly save hundreds on my premium for the year. That’s more money toward my savings goals!

Pro Tip: Shop around annually and adjust coverage based on your current needs.

10. Parking and Valet Fees That Add Up

I see people all the time paying for luxury parking when dining or staying in big cities, luxury resorts, theme parks, etc. But is it always because they have to? No.

Pro Tip: Choose free or cheaper parking options whenever possible and consider that extra money for your pocket later!

11. Buying Big-Ticket Items at the Worst Time

Think about buying a car, moving into an apartment, shopping for major appliances or electronics, booking travel and vacation, etc. If you can plan your purchases during off-peak seasons, this little bit of strategy can mean huge cost savings for you.

Pro Tip: Plan major purchases during off-peak times to get better deals.

Find Smart Tools to Budget Better, Save More, and Work From Anywhere

Ready to make life (and money management) a little easier? Check out my favorite tools, books, and essentials for budgeting smarter, building real savings, organizing your home office, and thriving in remote work—so you can create the flexible lifestyle you’re working toward.

Final Thoughts: Keep More Money Without Feeling Deprived

Cutting back on unnecessary expenses doesn’t mean cutting out everything fun. It just means being more intentional with your money—so you’re spending on what matters most and building habits that actually support your goals.

Whether you’re trying to save more, stick to your budget, or finally feel in control of your finances, it starts with being aware of where your money’s going—and deciding if it’s really worth it.

Start with a few small changes from this post and stack on more as you go. You’ll be surprised how much further your money goes (without feeling like you’re depriving yourself in the process).

Remember, you work hard for your money. So let’s make sure it’s working just as hard for you.

You’ve got this! Drop a comment down below to let me know which tip(s) you’re looking forward to implementing and what questions you have to get started.

Next up in the blog series

In the final part of this blog series (part 10), we’re going to dive into the power of adopting a positive money mindset and how crucial this is for transforming your finances. Click here to read now!